About Broker Mortgage Rates

Wiki Article

Not known Facts About Broker Mortgage Meaning

Table of ContentsEverything about Mortgage Broker Average SalaryThe Only Guide for Mortgage Broker AssistantThe Best Guide To Mortgage Broker SalaryExcitement About Mortgage Brokerage3 Easy Facts About Mortgage Broker Meaning ExplainedMortgage Broker Salary Can Be Fun For EveryoneBroker Mortgage Rates Fundamentals ExplainedAbout Mortgage Broker Assistant Job Description

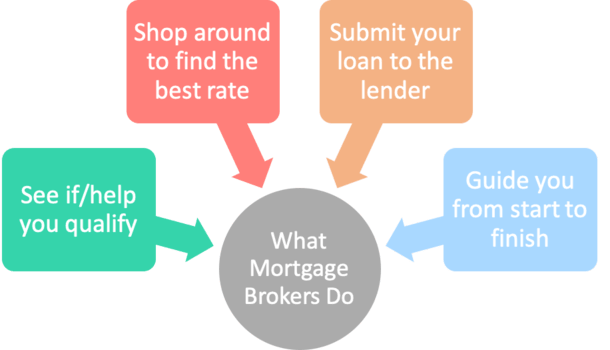

A broker can compare finances from a bank as well as a credit rating union. A lender can not. Banker Salary A home mortgage banker is paid by the institution, commonly on a wage, although some establishments use monetary motivations or perks for efficiency. According to , her initial obligation is to the institution, to see to it fundings are effectively protected as well as the customer is totally qualified as well as will certainly make the lending settlements.Broker Compensation A home mortgage broker stands for the customer greater than the lending institution. His obligation is to obtain the consumer the finest deal possible, despite the institution. He is usually paid by the lending, a kind of payment, the distinction between the price he obtains from the loan provider as well as the price he offers to the borrower.

How Mortgage Brokerage can Save You Time, Stress, and Money.

Jobs Defined Knowing the advantages and disadvantages of each may help you decide which job path you intend to take. According to, the primary difference in between both is that the bank home loan officer stands for the items that the financial institution they function for deals, while a home loan broker deals with numerous lenders and serves as an intermediary between the lending institutions as well as client.On the other hand, bank brokers might find the work ordinary after a while since the process commonly remains the same.

Not known Facts About Broker Mortgage Near Me

What Is a Lending Policeman? You might recognize that locating a funding police officer is a crucial action in the procedure of obtaining your funding. Allow's review what car loan police officers do, what expertise they require to do their work well, and whether financing police officers are the very best option for consumers in the car loan application screening procedure.

Some Ideas on Mortgage Brokerage You Should Know

What a Car loan Officer Does, A car loan officer benefits a financial institution or independent loan provider to aid borrowers in getting a finance. Because several consumers function with finance police officers for home loans, they are commonly described as home mortgage funding policemans, however lots of loan police officers help borrowers with other financings as well.If a car loan policeman believes you're eligible, after that they'll recommend you for authorization, and also you'll be able to proceed on in the process of getting your funding. What Funding Police Officers Know, Financing policemans should be able to work with consumers and little company proprietors, and they have to have considerable expertise concerning the market.

Not known Facts About Mortgage Broker Vs Loan Officer

Just How Much a Funding Policeman Prices, Some funding police officers are paid via commissions (mortgage broker meaning). Mortgage car loans often tend to broker mortgage compliance result in the biggest commissions due to the fact that of the size and also workload associated with the funding, but commissions are usually a flexible prepaid fee.Car loan police officers understand everything about the many kinds of lendings a lender may offer, as well as they can give you suggestions about the best option for you and your circumstance. Review your requirements with your loan police officer. They can help guide you towards the very best funding kind for your circumstance, whether that's a traditional funding or a big finance.

Everything about Mortgage Broker

2. The Duty of a Financing Police Officer in the Testing Process, Your financing officer is your straight get in touch with when you're using for a funding. They will research as well as examine your financial background and assess whether you receive a home loan. You will not have to stress over consistently calling all the people involved in the home loan process, such as the underwriter, realty representative, settlement lawyer as well as others, due to the fact that your lending police officer will certainly be the point of get in touch with for all of the involved celebrations.Due to the fact that the process of a finance deal can be a facility as well as costly one, many consumers choose to deal with a human site here being as opposed to a computer system. This is why financial institutions might have a number of branches they intend to serve the prospective consumers in numerous areas that intend to fulfill face-to-face with a financing police officer.

The Definitive Guide for Broker Mortgage Near Me

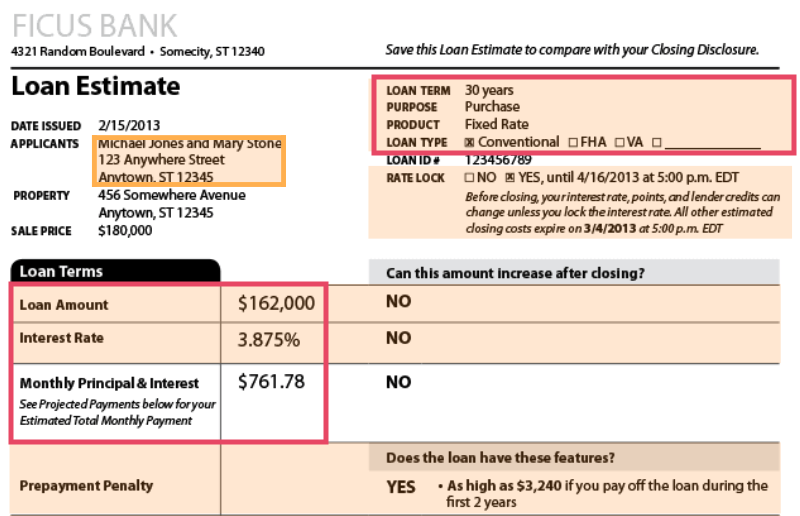

The Duty of a Loan Policeman in the Finance Application Process, The home mortgage application procedure can feel frustrating, particularly for the newbie homebuyer. When you work with the ideal financing police officer, the procedure is in fact pretty easy.Throughout the lending processing stage, your financing officer will contact you with any kind of inquiries the finance processors may have concerning your application. Your financing officer will after that pass the application on the expert, who will certainly assess your creditworthiness. If the underwriter authorizes your loan, your finance police officer will then accumulate and More hints also prepare the appropriate finance shutting papers.

The Only Guide to Mortgage Broker Assistant Job Description

So just how do you select the ideal car loan officer for you? To start your search, start with lenders that have a superb online reputation for surpassing their customers' assumptions as well as preserving industry criteria. As soon as you've picked a lending institution, you can then start to tighten down your search by interviewing lending officers you may wish to collaborate with (broker mortgage calculator).

Report this wiki page